- Guide

- Sony Bank WALLET

Sony Bank WALLET

Sony Bank WALLET is a cash card with Visa Debit functionality. Not only can you withdraw cash in Japan and more than 200 other countries and regions, you can also make payments anywhere in the world directly from your yen or foreign currency saving accounts all from one card.

1. Product overview

Supported currencies

Sony Bank WALLET supports Yen, US Dollar, Euro, British Pound, Australian Dollar, New Zealand Dollar, Canadian Dollar, Swiss Franc, Hong Kong Dollar, South African Rand, and Swedish Krona.

If you want to use your Sony Bank WALLET with one of the foreign currencies above, we recommend you opening a foreign currency account for this currency.

Sony Bank WALLET fees

You will be charged the following fees when making Visa Debit payments using your Sony Bank WALLET. The fees differ depending on whether you have an account in the local currency or not.

- Local currency account with balance

- If you have an account with balance in the local currency (*1) you wish to make Visa Debit payments with, the purchase amount in local currency will be directly taken from your foreign currency savings account. We won’t charge you any fees.

- Local currency account without balance

-

If you have an account in local currency (*1), but insufficient balance, you can still make Visa Debit payments. The shortfall in local currency will be exchanged directly from your yen savings account.

- The fees are:

- Sony Bank foreign exchange fee

- Without a local currency account

-

Even if you don’t have an account in the local currency, or use a currency not supported by Sony Bank WALLET(*1), you can still make Visa Debit payments, as the entire amount of local currency will be exchanged from your yen savings account.

The fees are:

- Visa foreign exchange fee

- 1.79% processing fee (consumption tax included) per payment

- (*1) The local currencies for which you can have an account are US Dollar, Euro, British Pound, Australian Dollar, New Zealand Dollar, Canadian Dollar, Swiss Franc, Hong Kong Dollar, South African Rand, and Swedish Krona.

- In some countries, you might be charged an additional fee when using your Sony Bank WALLET.

For the information on fees of withdrawing money at overseas ATMs, please check overseas ATMs.

2. Using your card in Japan

Sony Bank WALLET provides you maximum convenience for your day to day shopping without the need to carry cash. You can use it for the following purposes.

Cashless shopping

Use your card for payment in stores in Japan where Visa is accepted. When paying with your card, the amount will be deducted immediately from your yen savings account.

In order to use the card in stores, hand over your card and say in Japanese:

"Visaカード、1回払いで (Visa card, ikkai barai de)", which means Visa card, in one payment.

Tap to pay with Sony Bank WALLET

You can pay with a single tap. With a Visa contactless payments, you can tap to pay for your everyday purchases at many of your favorite merchants.

Some stores might require your Visa Debit PIN or signature. For benefits related to shopping with Sony Bank WALLET. Please check the Club S cashback.

There are some stores that don’t accept Sony Bank WALLET, please check the unavailable store list.

Cash deposits and withdrawals

Use your Sony Bank WALLET to deposit and withdraw money from approximately 90,000 partner ATMs.

Just insert your card into the ATM card reader with the IC chip facing up and pointing away from the machine. For more info, please check ATMs in Japan.

3. Using your card outside Japan

When you use Sony Bank WALLET outside Japan, the amount you spend will be debited from your foreign currency savings account. You can use it for the following purposes.

Cashless shopping

Shop outside Japan with your Sony Bank WALLET at stores where Visa is accepted. In order to use the card in stores, hand over your card for payment. Some stores might require your Visa Debit PIN or signature.

- There might be locations where "Visa Debit" is not available. In such cases, select "Visa credit" in order to process the payment.

- Some stores allow you to select the desired currency for payment. If you do have an account in the local currency, it's recommended to choose that to avoid additional exchange fees.

Cash withdrawals at overseas ATMs

Withdraw local currency at overseas ATMs marked with VISA and/or VISA PLUS.

Just insert your card into the ATM card reader, with the IC chip facing up and pointing towards the machine. For more info, please check overseas ATMs.

Caution when using outside Japan

- Refunds in foreign currency

- If you make payments from your foreign currency savings account and cancel them, the refund will be in that foreign currency and not in Japanese yen, even if the amount was automatically exchanged from your yen savings account.

- Foreign currency amount adjustment

- If you do not have a foreign currency savings account with Sony Bank, or if you use a currency other than the currencies Sony Bank WALLET supports, the amount of foreign currency will be directly exchanged from your yen savings account at the time of purchase / withdrawal. Since it takes several days for your purchase data (usage data) to be sent from Visa to Sony Bank, the exchange rate at time of purchase and time of purchase confirmation may differ. Sony Bank will calculate the difference and either withdraw or refund the amount from/to your yen savings account.

4. When shopping online

Use your card to shop online at stores where Visa is accepted; they are usually marked with the VISA logo. For online shopping, choose "Credit card" as the preferred payment method during the check-out phase. For security reasons, some stores might require a 3D secure password.

3D Secure personal authentication

3D Secure refers to free personal authentication services used to prevent unauthorized use of your credit or debit card by a third party when you shop online. Such authentication is performed when deemed necessary by Sony Bank.

3D Secure personal authentication services are used by participating online stores and businesses.

- How to use additional authentication with a 3D Secure one-time password

-

If additional authentication is required, an email containing a one-time password will be sent to your registered email address.

If you would like to receive your 3D Secure one-time password using a different email address, please sign in to our English online banking, go to "Sony Bank WALLET" from the Menu, and select "Visa Debit personal authentication settings" to set your preferred address.

- Additional authentication process

-

Step 1

If you have multiple email addresses registered with Sony Bank, select your preferred email address for receiving the 3D Secure one-time password notification emails from the options listed. -

Step 2

After receiving the notification email, enter the 3D Secure one-time password on the transaction screen.

Notification emails will be sent in both Japanese and English.

5. Benefits

Get great benefits when shopping with Sony Bank WALLET.

Cashback

With our cashback program, you get cashback when shopping with your Sony Bank WALLET in Japan. Cashback rates are applied differently according to your Club S membership level. For more information, please check Club S.

- You cannot earn cashback on any payments, in or outside Japan if you pay with a currency other than yen. Please note that in some cases online shopping in Japan may be treated as an overseas transaction and therefore will not be eligible to cashback rewards.

- The cashback you earn each month will be credited to your account on or around the 25th of the following month.

- Delays in cashback might occur due to data transfer between Sony Bank and Visa system, in these cases you should expect the cashback around the 25th, three months from the purchase month.

- If you cancel your account at the time of cashback, you won’t be eligible to receive that cashback.

Maximum cashback amount

The maximum amount of cashback you can earn per month is 200,000 yen. However, for (1) and (2) below, there is a limit to the amount of cashback that you can earn for certain transactions.

- Cashback amount limit by merchant

- Up to 10,000 yen per merchant per month of cashback on the following merchants:

-

- Yahoo!Kantan Kessai

- TB Auction

- Cashback amount limit on donations, tax payments, and utility bills,etc.

Up to 10,000 yen per month of cashback for the total amount of your donations, taxes and utility bills. The following are examples of transactions that are subject to this cashback amount limit. In addition, if we determined that the data sent from Merchants fall under the category of donations, tax payments, utility bills, etc., it will be subject to the cashback amount limits.

- Examples

-

- Taxes (taxes which can be payable with a credit card)

- Furusato nōzei (hometown tax donation)

- Utility bills

- NHK broadcast subscription fees (Japan Broadcasting Corporation)

- Donations

- Payments to local governments, non-profit organizations, etc.

- Public facilities usage charge

- Japanese National Pension contributions, National Health Insurance premiums

2% cashback at PlayStation™Network / PlayStation®Store

We will cashback 2.0% of the amount spent on PlayStation™Network / PlayStation®Store in Japan, regardless of your Club S membership level.

3% discount at Sony stores

Get 3% discount on purchases via Sony online store or Sony stores in Ginza (Tokyo), Sapporo (Hokkaido), Nagoya (Aichi), Osaka, and Fukuoka-Tenjin (Fukuoka).

Some products and services might not be eligible for discounts.

Receive 1,000 yen present

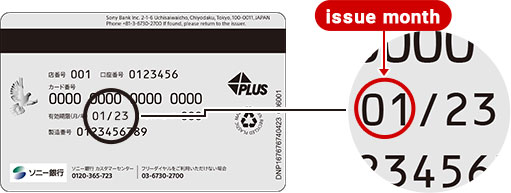

You can earn 1,000 yen if you use your Sony Bank WALLET more than 5 times by the end of the second month after the month in which your card was issued. The 1,000 yen present will be deposited to your Yen savings account four months after your card issue month, on or around the 25th. You can check your card issue month on your card.

- You cannot earn the 1,000 yen present on any payments outside Japan, or inside Japan if you pay with a currency other than Yen.

- Please note that some online shopping in Japan may be treated as overseas card use, and therefore will not earn the 1,000 yen present.

- You will not be eligible for this benefit if you can cancel your account.

- Sony Bank reserves the right to change terms and conditions at any time without prior notice.

- Illegal activities in pursuit of this benefit are prohibited.

6. Insurance

When using Sony Bank WALLET for shopping, we protect your purchases in case of theft or accidental damages, within 60 days of the purchase date. We will reimburse you the value of the items up to the maximum of 500,000 yen in a year. In order to file a claim, you will need to fill in and provide the following documents. For more information, please check insurance coverage.

- Compensation is subject to a 5,000 yen deductible per claim.

- Incident reports are accepted 24 hours a day / 365 days a year.

- If you are calling from overseas or if toll-free is not available, please contact us from the website of Mitsui Sumitomo Insurance Co., Ltd.

- Please check Mitsui Sumitomo Insurance Company, Limited website and call their toll-free number when calling from Japan.

- Please tell the reception that you want to process a shopping insurance claim (Personal property comprehensive insurance) which is contracted between Sony Bank and Mitsui Sumitomo Insurance Company, Limited.

- Please note that the insurance company will determine whether to accept your insurance claim or not.

7. Card safety & security

Your card safety is important to us. Please read through the following instructions.

Cash withdrawal limit

Setting your cash withdrawal limit defines the amount of money you can withdraw at partner ATMs in Japan. Initially, the amount is limited to 2 million yen per day (changeable between 0 and 2 million yen).

- How to set the cash withdrawal limit

-

- Sign in to our Online banking

- Select Settings from Menu

- Scroll down to Set/Change withdrawal limit

- Select Set/Change

- Open Cash withdrawal limit settings

- Set your preferred limits

Visa Debit usage limit

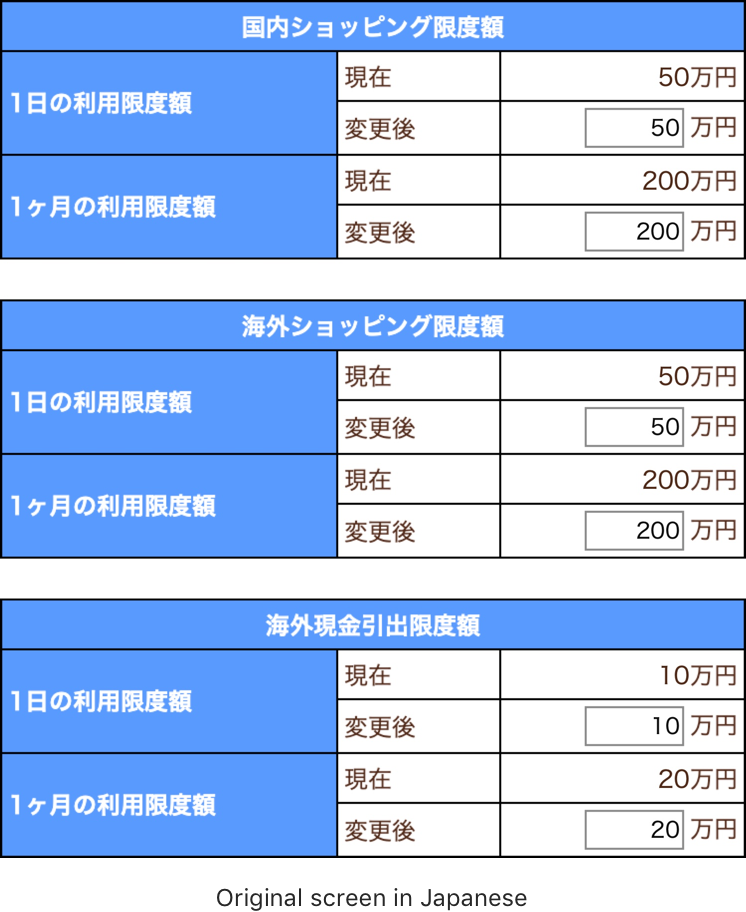

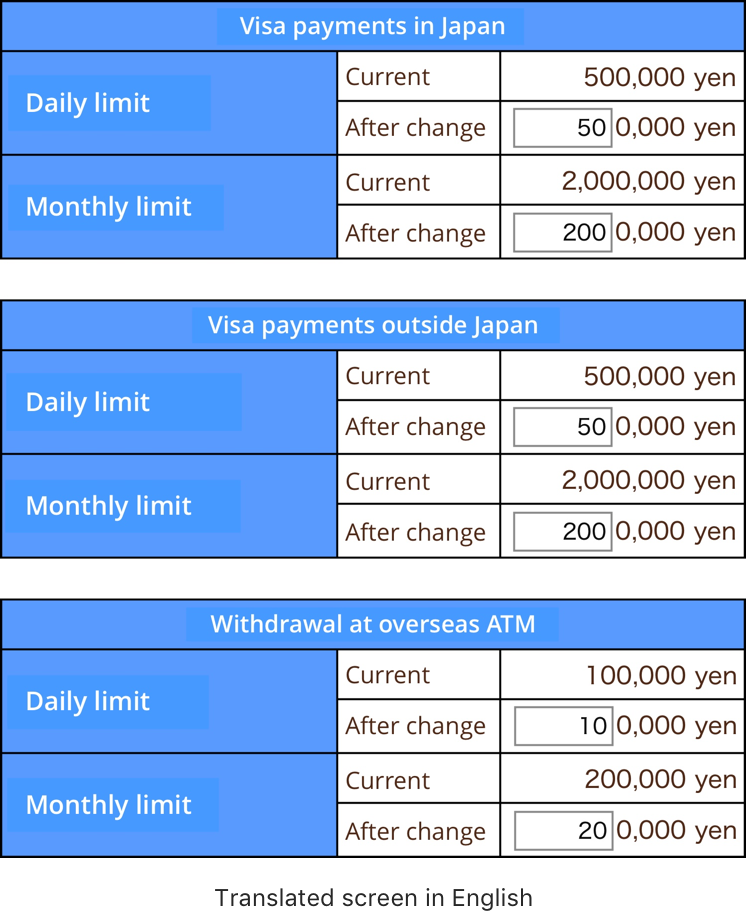

You can set daily and monthly limits for usage of the Visa Debit function of your Sony Bank WALLET.

Payments in and outside Japan are initially limited to 500,000 yen per day (changeable between 0 and 2 million yen) and 2 million yen per month (changeable between 0 and 10 million yen).

The amount you can withdraw at overseas ATMs is initially limited to 100,000 yen per day and 200,000 yen per month (both changeable between 0 and 1 million yen).

- How to set your Visa Debit usage limit

-

- Sign in to our Online banking

- Select Sony Bank WALLET from Menu

- Select Visa Debit usage limit settings

- Set your preferred limits

The information on the limit settings screen is provided in Japanese. Please check the image below. Enter your desired amount in multiples of 10,000 yen.

E.g. 50万円 = 50 x 10,000 yen = 500,000 yen

The initial usage limit may be subject to change without prior notice.

Notifications of fund transfer and use of the card

You can set up notifications on your card usage to an optional second email address and by doing so proactively monitor your account.

- How to set up notifications

-

- Sign in to our Online banking

- Select Settings from Menu

- Scroll down to Set/Change withdrawal limit

- Select Set/Change

- Open Email notification settings for fund transfer and use of the card

- Select which notifications you would like to receive

Notifications are always sent to your email address 1.

Block your card

You can temporarily suspend all card functions such as deposits, withdrawals, and payments.

- How to suspend the functions of Sony Bank WALLET

-

- Sign in to our Online banking

- Select Settings from Menu

- Scroll down to Set/Change withdrawal limit

- Select Set/Change

- Suspend Cash card functions

- Open Suspend/resume use of Cash card function

- Select All functions of cash card suspended from the dropdown

- Suspend Visa Debit card functions

- Open Suspend/resume use of Visa Debit card

- Select Suspended from the dropdown

Report card loss

If you have lost your card, please report the loss by following the procedure below or contacting the English help desk. Reporting the card as lost will block all card functions.

- How to report card loss

-

- Sign in to our Online banking

- Select Settings from Menu

- Scroll down to Report lost card

- Select Report lost card

- Follow the instructions on the screen

8. Compensation for unauthorized use

If your Sony Bank WALLET is fraudulently used due to loss or theft, we will compensate you for loss or damage incurred on or after the 30th day prior to the date of notification to us, within your daily usage limit.

In case of unauthorized use, please refer to our "English help desk" page for the contact information and report the incident as soon as possible.

We may not be able to compensate for damages, or the amount of compensation may be reduced, caused by the customer's intention or gross negligence.

Examples:

- If you give your Sony Bank WALLET to someone other than when shopping or using an ATM.

- If you disclose your Visa Debit PIN or your password for Visa Debit personal authentication. (This includes carrying a notebook with the authentication information or storing a password to the cloud etc. without setting passwords, etc.)

For details, please refer to our TERMS AND CONDITIONS FOR SONY BANK VISA DEBIT AGREEMENT.

Related guides

-

Club S

Learn more about our Club S rewards program and benefits with different Club S levels.

Learn more

-

ATM

Learn more about ATM usage and fees, when withdrawing cash in and outside Japan.

Learn more

-

Foreign currency deposit

Learn more about your foreign currency savings account, for trading foreign currency and making payments.

Learn more