- Guide

- Club S

Club S

Club S is a rewards program designed to provide our valuable customers access to greater convenience and benefits at Sony Bank. There are three stages – Silver, Gold and Platinum – which are determined based on your transaction status.

1. Preferential cashback rate

You can earn cashback when shopping with your Sony Bank WALLET in Japan. Cashback rates differ according to your Club S level.

- More information about cashback:

-

- You cannot earn cashback on any payments, in or outside Japan, if you pay with a currency other than Yen. Please note that in some cases online shopping in Japan may be treated as an overseas transaction and therefore will not be eligible for cashback rewards.

- The cashback you earn each month will be credited to your account on or around the 25th of the following month.

- If you cancel your account before you receive cashback, you won’t be eligible to receive that cashback.

- The maximum amount of cashback you can earn per month is 200,000 yen. For details, please check Cashback.

- PlayStation™Network / PlayStation®Store cashback

- We offer 2% cashback on every purchase at PlayStation™Network / PlayStation®Store in Japan, regardless of your Club S level.

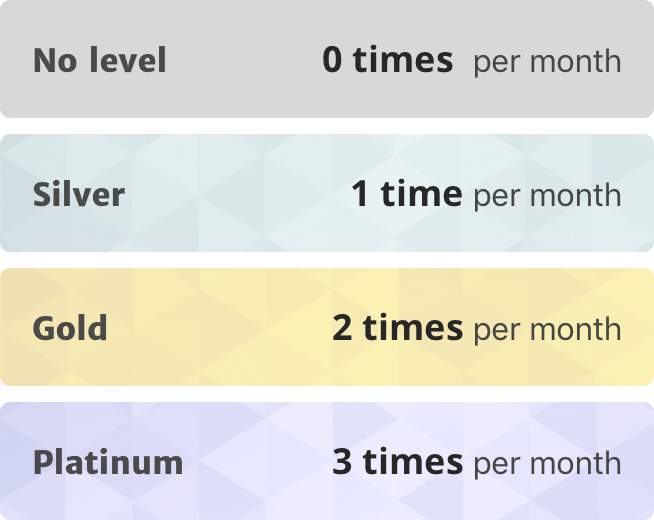

2. Fee-waived overseas ATM usage

If you withdraw a local currency for which you don't have a foreign currency savings account, or which Sony Bank doesn't support, the usual overseas ATM fee is 220 yen (consumption tax included). We will initially deduct this fee at the time of withdrawal but refund it into your yen savings account the following month. You can be refunded for up to three withdrawals in a single month, depending on your Club S level.

- If you make a withdrawal in a local currency for which you do have a foreign currency savings account, we will not charge an overseas usage fee, however there will be a 1.79% processing fee, which is not refundable. For details, please check Overseas ATMs fees.

- ATM providers might charge additional fees, which are also not refundable.

- Please note that if for some reason you cancel your withdrawal at an overseas ATM, the remaining number of fee-waived withdrawals may not be displayed correctly on our English online banking.

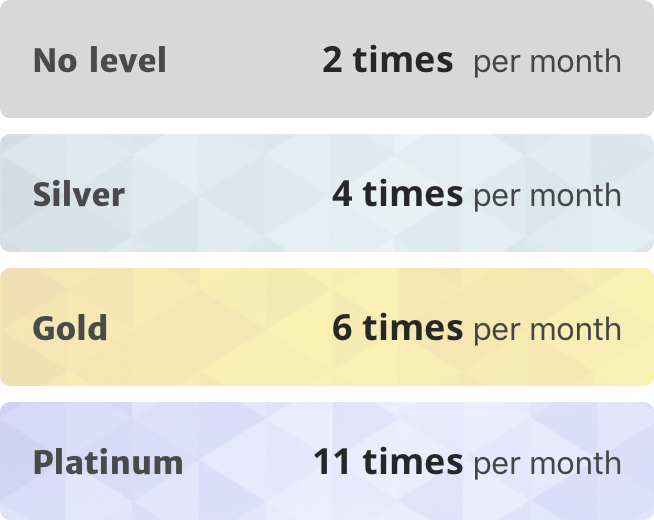

3. Fee-waived fund transfer

If you transfer funds from your Sony Bank account to other financial institutions in Japan the usual fee is 110 yen (consumption tax included). However, you can enjoy fee-waived fund transfers within Japan up to eleven times per month, depending on your Club S level.

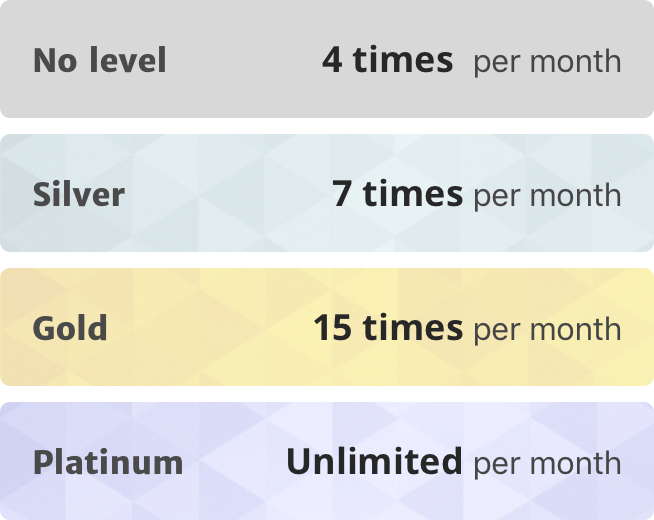

4. Fee-waived partner ATM usage in Japan

If you withdraw Japanese Yen at partner ATMs in Japan, the usual ATM fee is 110 yen (consumption tax included). However, you can enjoy fee-waived usage, depending on your Club S level.

Balance inquiries and deposits are free at all times regardless of Club S levels.

5. Preferential exchange fee per levels

Exchange against:

- Exchange fees shown above may change without notice in response to fluctuation in the foreign exchange market or at our discretion.

- During promotional campaigns on exchange fee you might be able to benefit from better conditions regardless of your Club S level.

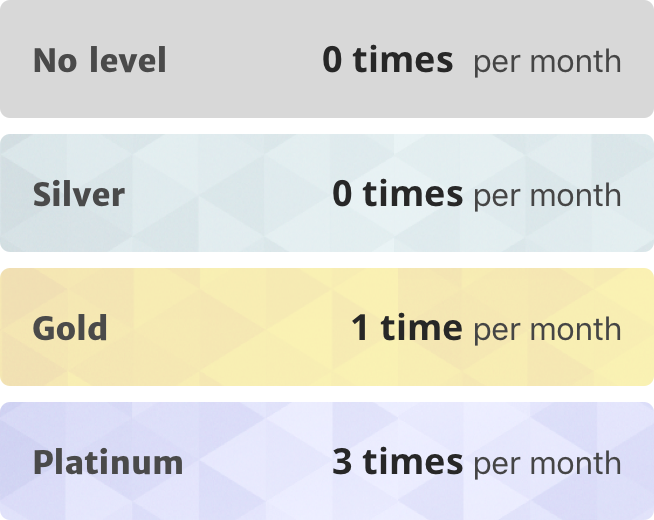

6. Fee-waived Outgoing foreign currency remittance

If you make a foreign currency remittance from Sony Bank to financial institutions outside of Japan, Sony Bank usually charges 3,000 yen per remittance. However, you can enjoy fee-waived foreign currency remittances, depending on your Club S level.

Please note that there will be an additional 3,000 yen paying bank's charge regardless your Club S level. For details, please check Outgoing foreign currency remittance.

7. Club S criteria

Your Club S level is based on your account/transaction status at the end of the month.

- Silver

- Total balance (Yen deposit and foreign currency deposits balance) is equivalent to more than 3 million yen.

- Gold

- Foreign currency deposits balance is equivalent to more than 5 million yen and less than 10 million yen.

Yen deposit balance is not considered as assessment criteria. - Platinum

- Foreign currency deposits balance is equivalent to more than 10 million yen.

Yen deposit balance is not considered as assessment criteria.

- Calculation method for Foreign currency deposit balance (Yen-equivalent amount):

- Balance at the end of the month x TTB rate

- The rate used for Yen-equivalent is the TTB rate on the last day of the month (as of 0:00 am JST). If the last day of the month falls on a Sunday or Monday, the rate will be calculated based on the rate on the preceding Saturday. The TTB rate will be calculated using the standard exchange fee regardless of the Club S level.

- Please note that transaction status is currently determined by products and services that are only available via our English online banking. You may also be qualified if you have certain products/services which are only available via our Japanese language website.

For details, please visit the Japanese language website.

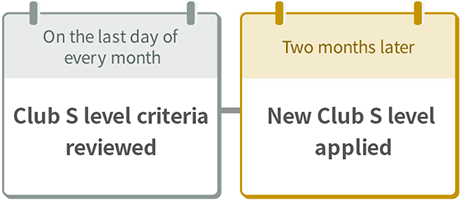

8. Club S level review process

On the last day of every month, we review your balance to determine your Club S level.

Your new Club S level will be applied two months later.

Your Club S level for the month will be announced by email on the first business day of every month.

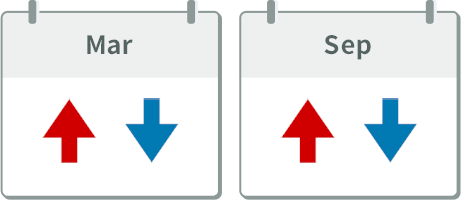

- Timing of Club S level downgrade assessments

- Your Club S level is reviewed and you have a chance to upgrade every month. However, assessments for Club S level downgrades occur twice a year, in March and September. Depending on your balance, your level could be downgraded.

- For months other than March and September, you will be able to maintain your upgraded level regardless of whether or not your account balance dips below the required level balance criteria.

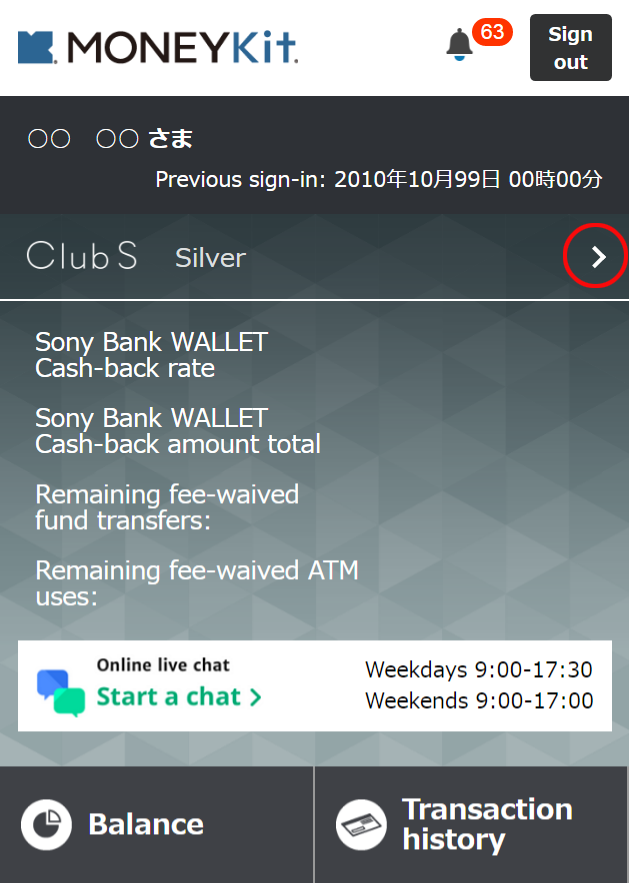

9. Checking your Club S level

You may check your Club S level for the current month and following month after signing in to our English online banking. Please select Club S on the top page.

Related guides

-

ATM

Learn more about ATM usage and fees, when withdrawing cash in and outside Japan.

Learn more

-

Fund transfer

Learn more about fund transfer in Yen to/from Sony Bank and other banks in Japan.

Learn more

-

Foreign currency deposit

Learn more about your foreign currency savings account, for trading foreign currency and making payments.

Learn more