- Blog

- article

Ever thought about buying foreign currency, but never knew when the right time to start was due to daily fluctuations in the foreign exchange rate? You are not alone.

The reality is, you can only find out the right timing afterward, and what's more, even highly experienced professionals find it difficult to accurately predict foreign exchange rates. In order to take the leap and start building your Foreign currency savings, how about starting with a small amount of spare cash that you're not planning to use anytime soon? In addition, it's more important to trace the movement of the Foreign exchange rate over six months, a year, or even longer, instead of wondering about daily fluctuations.

Use Dollar-Cost Averaging Method

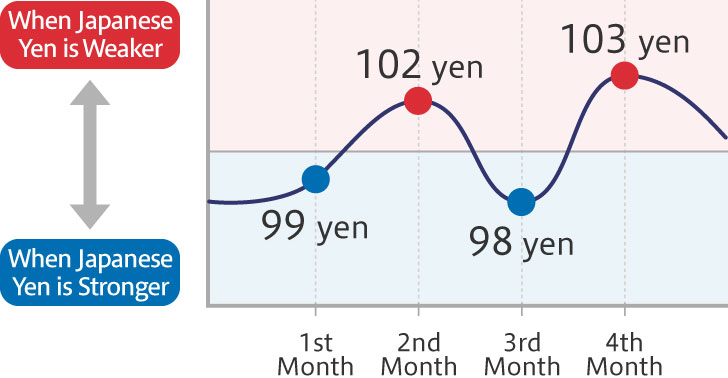

Everybody wants to buy foreign currency when it's cheap. However, whether the rate is high or low can only be reflected on after the fact. Therefore, a common way to diversify investment timing and manage the risk is through dollar-cost averaging.

Dollar-cost averaging is a simple strategy that involves investing the same amount of Japanese Yen in a foreign currency at regular intervals, say monthly. For example, putting the same amount of Japanese Yen every month to buy US Dollars, no matter the exchange rate is up or down. When the Japanese Yen is stronger, the same amount of Yen can buy more US Dollars; when the Japanese Yen is weaker, fewer US Dollars. As a result, the average cost per US Dollar is lower than buying the same amount of US Dollars each month, which compensates for the uncertainty of exchange fluctuations.

Although the dollar-cost averaging method is suitable for long-term investment planning, it's not a guaranteed way to make profits; it's merely a means of spreading out risk.

Diverse Foreign Currency Portfolio

One way to reduce the fluctuations is by investing multiple foreign currencies, rather than concentrating on a single currency. In other words, the exposure to a diversified currency portfolio usually entails less exchange rate risk than if all the portfolio exposure were in a single foreign currency.

One way to reduce risk is to deposit in foreign currencies that move in different directions. For example, investing US Dollars, which is the world's key currency, with the currencies which often move in the opposite direction.

Comprehend Foreign Exchange Movement

Foreign exchange rates are affected by various political and economic developments around the world. With this in mind, it is important to think, "how will this development affect my Foreign currency deposits?" when following the news on a regular basis. Even news from a country other than one from which you have foreign currency is often closely related to other countries around the world. Through this exercise, you can gain a sense of factors that can affect the movement of a currency's exchange rate. Once you’ve acquired this skill, you will be able to comprehend how the Foreign exchange rate moves, and as a result, better enjoy building your Foreign currency savings.

Additionally, one other important thing to do is to regularly read Foreign exchange rate charts. The more you follow foreign exchange market trends, the more confident you will become in shaping your own perspectives. It's important to comprehend both long-term and short-term movements in Foreign exchange rates.

Now that you know what it takes to build your Foreign currency savings, why not sign in to our English online banking and start building your foreign currency today?

Learn more about Foreign currency deposits

Important Matters Concerning Foreign Currency Deposits

Share this article