- Blog

- article

Although you have probably heard of Foreign exchange fees before, you might not be able to quite figure out when you have to pay them or what you have to pay them for.

In this article, we break down Foreign exchange fees in layman's terms.

What are Foreign exchange fees?

Foreign exchange fees are a type of fee incurred when customers buying and selling foreign currencies with a bank, and the customers who make these type of transactions are responsible for paying Foreign exchange fees.

So, why are Foreign exchange fees applied to Foreign currency deposit transactions?

In general, there are no fees for Yen deposits. On the other hand, when you deposit funds from your Yen savings account into your Foreign currency savings account, the process involves selling Yen and buying foreign currency. As such, the bank needs to procure foreign currency based on exchange rates that are fluctuating in real time as well as assign dedicated systems and personnel, and thus associated costs are added as Foreign exchange fees.

One thing to keep in mind is that Foreign exchange fees vary from one financial institution to another! Online banks, such as Sony Bank, typically have relatively low Foreign exchange fees.

Incidentally, TTS (Telegraphic Transfer Selling Rate) is the exchange rate at which a customer buys foreign currency from a bank, while TTB (Telegraphic Transfer Buying Rate) is the exchange rate at which a customer sells foreign currency. Both TTS and TTB include Foreign exchange fees, so customers don't have to pay any additional fees other than Foreign exchange fees.

Foreign exchange fees may seem like an insignificant amount at first glance. However, since they are applied when you "buy" and "sell" foreign currency, the actual amount received may be less than expected.

How do differences in Foreign exchange fees affect my transaction amount?

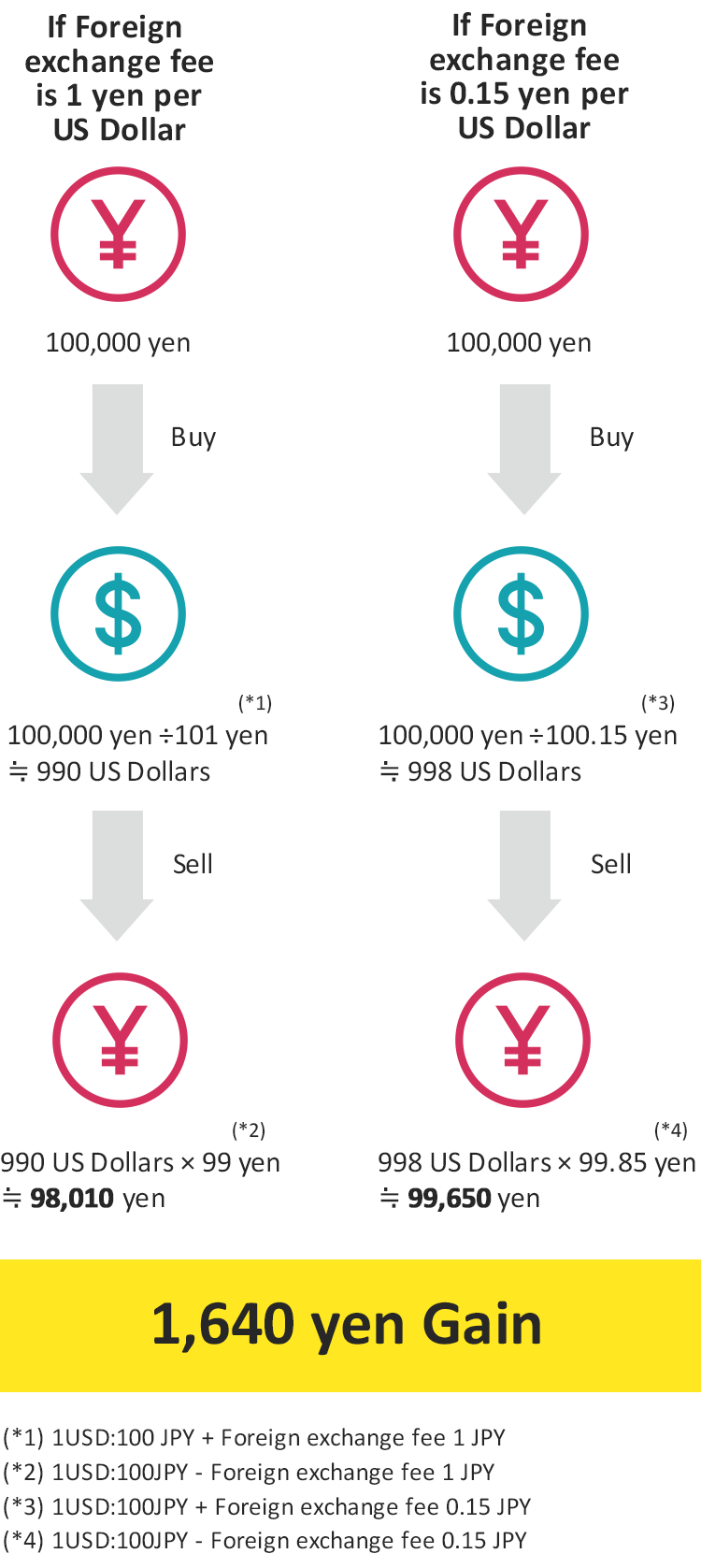

Next, let's look at the difference in the transaction amount with different Foreign exchange fees using actual figures.

Take the example of buying 100,000 yen equivalent of US dollars at the exchange rate of 100 yen per US Dollar, and selling U.S. dollars at the same exchange rate. The flow of funds for each respective foreign currency transaction is shown in the diagram below.

As shown in the diagram above, a Foreign exchange fee is charged twice, once when buying and once when selling foreign currencies. Therefore, even a small difference in the Foreign exchange fee can make a big difference to the transaction amount.

Limited-time offer: FREE Foreign Exchange Fees!!

Sony Bank offers all customers who’ve opened a bank account with us the opportunity to enjoy FREE exchange fees when buying foreign currencies from Japanese yen.

This limited-time offer is available from the date of account opening until the end of the second month after the month in which your bank account was opened.

If Foreign exchange fee is free when buying foreign currencies from Yen, it's easy to get started with buying foreign currencies, even if you haven't taken the plunge before!

Why not take advantage of this opportunity?

Important Matters Concerning Foreign Currency Deposits

Share this article